May 2025 Black Hills Real Estate Market Update: What a Buyer’s Market Means for You

As the fresh spring air fills the Black Hills and wildflowers start to bloom, the real estate landscape is also undergoing a seasonal—and strategic—shift. If you’ve been waiting for the “right time” to buy or wondering what your home is worth in today’s market, now is the time to pay attention.

Bas

Discover the Investment Opportunity of a Lifetime in Powderhouse Subdivision, South Dakota

Are you looking for a unique investment opportunity that combines high rental income with the chance to vacation for free? Look no further than the Powderhouse subdivision in Lead, South Dakota. This neighborhood in the Black Hills offers an unbeatable combination of location, amenities, and ren

Top 5 Tips for Staging Your Home in Winter for a Quick Sale

Make Your Home Shine Even in the ColdSelling your home in winter might feel like a challenge, however, with the right staging, you can turn the season into an advantage! Winter buyers are serious and motivated—they’re not just browsing especially if they are willing to face the brutal temptures Sout

Spearfish Real Estate: Why This Charming Town is a Gem for Homebuyers

Discover Spearfish’s Unique Appeal

Nestled in the northern Black Hills, Spearfish is more than just a scenic town—it’s a thriving real estate market with something for everyone. From first-time buyers to seasoned investors, Spearfish offers the perfect balance of community charm, outdoor adventure,

Winter 2025: Why Now’s the Best Time to Buy in the Black Hills

The Opportunity Winter Brings

Buying real estate in winter might sound counterintuitive, but in the Black Hills, it’s a game-changer. Lower competition, motivated sellers, and unique seasonal perks make this the perfect time to secure your dream home. Christians Team Real Estate, the leading expert

Unlock Hidden Investment Opportunities: Why Now is the Best Time for 1031 Exchanges in Real Estate

Why This Time of Year is Perfect for 1031 Exchanges in Real Estate

If you’re thinking about making some moves in real estate, now might be the perfect time to consider a 1031 exchange. This time of year is especially popular for 1031 exchanges, which are a way to swap one property for another witho

Charming Terry Peak Log Cabin: Your Perfect Vacation Retreat or Investment Opportunity

Nestled in the picturesque Terry Peak area of Lead, South Dakota, this stunning log cabin at 21180 Lookout Trail offers an idyllic escape from the hustle and bustle of everyday life. With a listing price of $638,500, this 1,952 square foot property is an exceptional opportunity for those seeking a

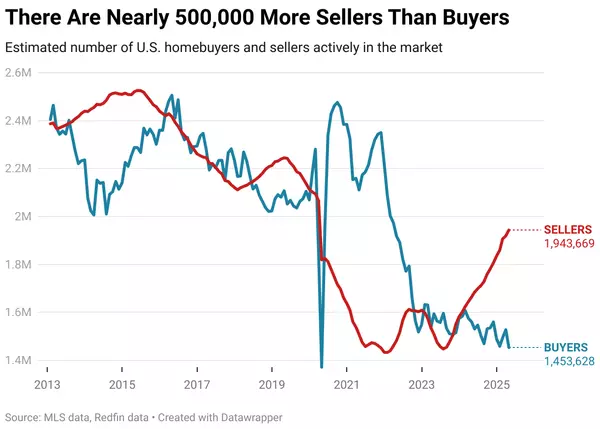

How Low Mortgage Rates Are Shaping Supply and Demand in the Black Hills Real Estate Market

The real estate market is driven by the principles of supply and demand, and few factors influence these dynamics as much as mortgage rates. The historic lows in mortgage rates experienced during the COVID-19 pandemic created unique conditions that still impact today’s housing market. For areas li

Top Compromises Homebuyers are Making in 2024

For the first time since 2020, housing affordability improved year over year. This is largely due to a drop in mortgage rates, which have dipped from 7.07% to 6.09% over the past year. While this is undoubtedly great news for home buyers, affordability remains a challenge for many.

According to re

What the Fed’s Rate Cut Means for the Housing Market

By now, you’ve probably heard about the news: the Federal Reserve recently cut interest rates for the first time in four years.

But what does that really mean for home buyers and sellers? You might be wondering how this impacts mortgage rates, home prices, or your ability to make a move in today’

How the 2024 Presidential Election Might Affect the Housing Market

No matter how many elections you’ve lived through, each one can feel a bit like a wildcard when November draws near and you’re wondering whether you should make a move—or wait until the dust settles.

Generally speaking, presidential elections have only a small and temporary impact on the housing ma

6 Things You Need to Know About The Changes to the Real Estate Industry

A little backstory:

Back in March, the National Association of Realtors (NAR) agreed to a settlement deal. The organization agreed to both a monetary settlement as well as real estate practice changes aimed at providing more transparency regarding how real estate agents are paid.

But how exactl

Buyer’s Relief? What Zillow’s Latest Report Reveals About the Housing Market

You may not feel it yet, but the housing market is shifting.

In July, the market shifted from a strong sellers’ advantage to more balanced neutral territory, according to Zillow’s latest market report.

So, what does this mean for you? Let’s dive in.

The Shift to a Neutral Market

For the first

Boost Your Home’s Appeal with These Affordable Upgrades

When it comes to selling your home, making a great first impression is crucial. But what if you don't have the budget for a major renovation.

Luckily, new data from Zillow and Thumbtack reveal that you don't need to break the bank to boost your home's appeal. "Certain low-lift projects can delive

194% ROI?! Unveiling the Home Remodeling Projects That Actually Pay You Back

Thinking about sprucing up your home? Whether you're planning to sell soon or just want to enhance your living space, remodeling can be a great investment. But not all projects offer the same return—especially since home repair costs have risen 40% since 2019.

I know remodeling costs today can be

Top Mortgage Assistance Programs in South Dakota

A recent study by Fannie Mae revealed a surprising lack of confidence among consumers about the mortgage process.

There’s good reason to feel a little cautious. Here in the Valley, home prices have risen 59% since 2020, and mortgage rates have also climbed. However, homeownership remains a top pri

Why 36% of Americans Choose Real Estate for Long-Term Wealth

When it comes to long-term investments, Americans have a clear favorite: real estate.

According to a recent Gallup poll, 36% of Americans believe real estate is the best long-term investment, outpacing stocks (22%), gold (18%), savings accounts (13%), bonds (4%) and cryptocurrencies (3%).

Why i

4 Mortgage Loan Mistakes That Could Cost You Money

There’s nothing like the moment when you’ve found your dream home. It’s easy to get caught up in the excitement and make moves to finalize everything as quickly as possible. And while timeliness is important, it can lead to mistakes that end up costing you thousands.

Here are the four biggest mis

Home Insurance on the Rise? Here's How to Save on Rates in 2024

Now, more than ever, having the right home insurance is essential.

But with rates on the rise, how do you ensure you're getting the best coverage without breaking the bank? Let's explore the ins and outs of home insurance and uncover some strategies to secure the best deal for your home in the Bl

Tax Benefits of Living in South Dakota

Living in South Dakota comes with several tax benefits that make it an attractive destination for individuals and businesses alike. Here are some of the key tax advantages of living in South Dakota:

1. No State Income TaxOne of the most significant tax benefits of living in South Dakota is the abse

Jeffery Christians

Phone:+1(605) 920-0425