How Low Mortgage Rates Are Shaping Supply and Demand in the Black Hills Real Estate Market

The real estate market is driven by the principles of supply and demand, and few factors influence these dynamics as much as mortgage rates. The historic lows in mortgage rates experienced during the COVID-19 pandemic created unique conditions that still impact today’s housing market. For areas like the Black Hills of South Dakota—spanning Rapid City, Spearfish, and surrounding communities—these trends have significant implications for both buyers and sellers.

The “Lock-In Effect” and Its Impact on Supply

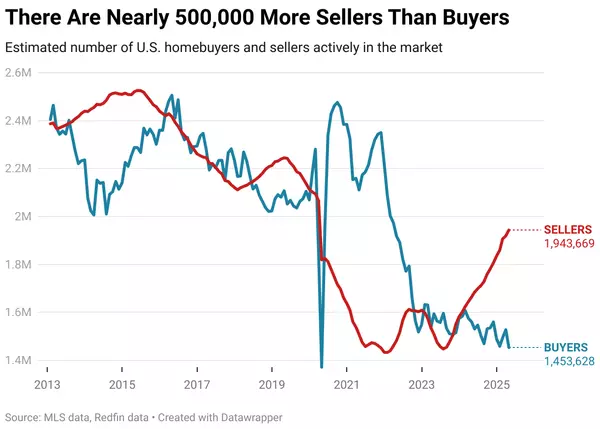

During 2020 and 2021, mortgage rates dipped to an unprecedented 2% to 3%, fueling a buying frenzy. According to Realtor.com, over 21% of outstanding mortgages as of late 2024 still carry rates below 3%, and 83% are below 6%. Homeowners who locked in these low rates are now reluctant to sell, creating a “lock-in effect” that limits the number of homes available for sale.

In markets like the Black Hills, where inventory is already tight, this trend exacerbates the shortage of homes on the market. With fewer homeowners willing to trade their low-interest mortgages for today’s higher rates—currently hovering near 7%—supply remains constrained, intensifying competition among buyers.

How Demand Is Affected

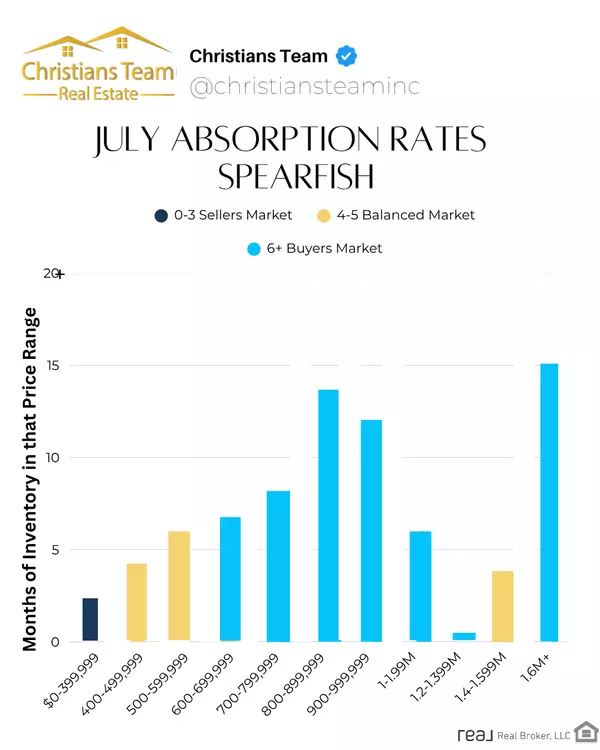

Despite higher rates, demand for homes in the Black Hills remains strong. Areas like Spearfish and Rapid City attract buyers seeking scenic beauty, outdoor activities, and a high quality of life. However, affordability is a growing concern as higher mortgage rates increase monthly payments. For example, a buyer looking at a $500,000 home in Spearfish would pay significantly more in monthly payments at today’s rates compared to the historically low rates of 2021.

This affordability gap has left many buyers waiting for rates to stabilize. A recent Realtor.com survey revealed that 40% of potential buyers would consider entering the market if rates dropped below 6%, and 32% would jump in if rates hit 5%.

Black Hills Market Outlook

As homeowners hold onto their low-rate mortgages, the limited supply in the Black Hills could keep home prices elevated, even with fewer transactions. This means buyers may face stiff competition for available properties in desirable areas like Rapid City and Spearfish.

For sellers, these conditions create an opportunity to command premium prices, especially if their homes are in prime locations or offer unique features. However, those considering selling must weigh the trade-off of losing their low-rate mortgage.

Looking ahead, easing inflation and falling mortgage rates could unlock more inventory. If rates were to dip below 6%, we could see increased seller activity in the Black Hills, helping to balance the market.

A Strategic Approach to Buying or Selling

Understanding the nuances of today’s real estate market is crucial. Whether you’re considering buying or selling in the Black Hills, working with an experienced real estate team can help you navigate these challenges. Our team at Christians Team Real Estate is here to provide expert guidance and insights tailored to your needs.

For more information on current trends and how they shape markets across the country, check out the full report on Realtor.com.

Are you ready to explore opportunities in the Black Hills? Contact us today for personalized advice and market updates.

Categories

Recent Posts

GET MORE INFORMATION

CEO-Broker | License ID: 15604